Physical Climate Risks and Underwriting Practices in Assets and Portfolios

Physical climate risk data can be a powerful tool for managing asset and portfolio risk and returns. Learn what strategies leading firms are using to manage physical climate risks and navigate market challenges. The latest report from the Urban Land Institute and LaSalle Investment Management builds on their previous report, How to Choose, Use, and Better Understand Climate Risk Analytics, to describe how leading firms are leveraging physical climate-risk data in underwriting practices. With insight into asset- and portfolio-level risk becoming increasingly easy to obtain, new challenges lie in effective interpretation and integration of information into investment practices. Relying on research and interviews with industry leaders, this report provides a nuanced exploration of this emergent issue.

Physical Climate Risks and Underwriting Practices in Assets and Portfolios is structured into three sections, each addressing different aspects of the industry's response to climate-risk data:

Section 1. Explore the current state of the industry, finding that:

- Leading firms actively coach their teams on physical risk.

- Regulatory trends affect, but do not motivate physical risk assessment.

- Different geographies approach physical with their own level of urgency.

- Investment managers tend to focus on fund risk, capital providers on portfolio risk.

- Tools to understand and price physical risk are still in a nascent stage of development.

Section 2. Examines the application of climate data in decision making. Key findings include:

- Aggregate physical risk is a screening tool; individual hazard risk is actionable information.

- Climate value at risk remains opaque; the utility of the single number offers value but needs increased transparency.

- Atypical hazard risk (e.g., flood in a desert) merits increased attention.

- External consultants can frequently fill skill gaps, especially for firms with less in-house expertise.

- While no predominant timeframe or Representative Concentration Pathway (RCP) emerged as industry standard, the 2030 and 2050 benchmarks were the most commonly referenced time horizon.

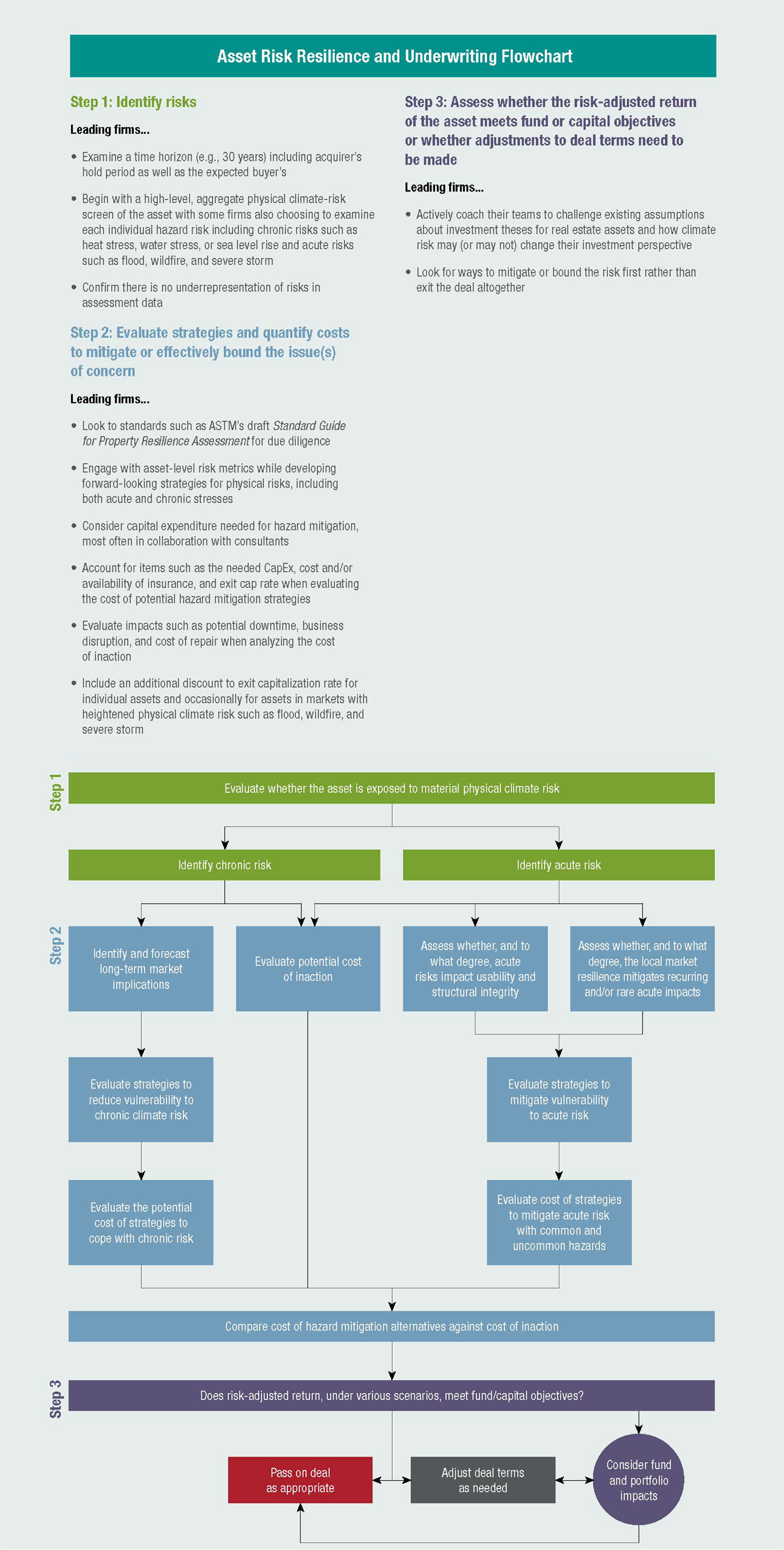

Section 3. Assess the impact of physical climate risk on acquisition, underwriting, and disposition practices; finding that:

- Leading firms start with a top-down assessment of physical risk.

- Market concentration of physical risk is analogous to other concentration risks—a nuanced analysis is required.

- Capital expenditure for resilience projections is a key forecast but rife with uncertainty.

- Local-market climate mitigation measures are important to understand but difficult to forecast.

- Exit cap rate discount for estimated physical risk is an increasingly commonly used tool, frequently 25 to 50 basis points.

- Firms infrequently disclose physical risk but the market needs increased transparency.

Read ULI's related report, How to Choose, Use, and Better Understand Climate-Risk Analytics.

Report Summary: Physical climate risk data can be a powerful tool for managing asset and portfolio risk and returns. Learn what strategies leading firms are using to manage physical climate risks and navigate market challenges. The latest report from the Urban Land Institute and LaSalle Investment Management builds on their previous report, How to Choose, Use, and Better Understand Climate Risk Analytics, to describe how leading firms are leveraging physical climate-risk data in underwriting practices. With insight into asset- and portfolio-level risk becoming increasingly easy to obtain, new challenges lie in effective interpretation and integration of information into investment practices. Relying on research and interviews with industry leaders, this report provides a nuanced exploration of this emergent issue.

Physical Climate Risks and Underwriting Practices in Assets and Portfolios is structured into three sections, each addressing different aspects of the industry's response to climate-risk data:

Section 1. Explore the current state of the industry, finding that:

- Leading firms actively coach their teams on physical risk.

- Regulatory trends affect, but do not motivate physical risk assessment.

- Different geographies approach physical with their own level of urgency.

- Investment managers tend to focus on fund risk, capital providers on portfolio risk.

- Tools to understand and price physical risk are still in a nascent stage of development.

Section 2. Examines the application of climate data in decision making. Key findings include:

- Aggregate physical risk is a screening tool; individual hazard risk is actionable information.

- Climate value at risk remains opaque; the utility of the single number offers value but needs increased transparency.

- Atypical hazard risk (e.g., flood in a desert) merits increased attention.

- External consultants can frequently fill skill gaps, especially for firms with less in-house expertise.

- While no predominant timeframe or Representative Concentration Pathway (RCP) emerged as industry standard, the 2030 and 2050 benchmarks were the most commonly referenced time horizon.

Section 3. Assess the impact of physical climate risk on acquisition, underwriting, and disposition practices; finding that:

- Leading firms start with a top-down assessment of physical risk.

- Market concentration of physical risk is analogous to other concentration risks—a nuanced analysis is required.

- Capital expenditure for resilience projections is a key forecast but rife with uncertainty.

- Local-market climate mitigation measures are important to understand but difficult to forecast.

- Exit cap rate discount for estimated physical risk is an increasingly commonly used tool, frequently 25 to 50 basis points.

- Firms infrequently disclose physical risk but the market needs increased transparency.

Read ULI's related report, How to Choose, Use, and Better Understand Climate-Risk Analytics.