- English

- 中文 (Chinese)

- Français (French)

- Deutsch (German)

- 日本語 (Japanese)

- Español (Spanish)

RCLCO Housing Progress Interactive Index

As housing attainability challenges in the United States have spread beyond the typical “high-cost coastal markets,” continued attention is needed regarding the relationship between slowing new housing supply and the crisis of affordability. Recent research indicates that there is a national production shortfall of 3.79 million housing units, with 169 regions experiencing underproduction as of 2019. Both indicators have worsened since 2012.[1] While there was a ramp up in supply coming out of Great Financial Crisis of 2008, affordability has been a consistent challenge across many major markets, and activity has not been equal across market sizes, geographies, or types.

While some markets continue to add, and a few even show signs of accelerating new supply, others including some so-called low barrier to entry markets, have stagnated. Of equal concern, density and diversity of new housing supply has only made marginal changes in most markets over the past decade. Growing deliveries of multifamily housing are one bright spot, but the response of the housing industry has been limited compared to changing demand conditions. Under-production and the continued dominance of the single-family home contribute to slow progress toward the goal of a housing delivery system for the U.S. that meets the consumer needs and economics and raising level of housing budget.

By one critical demand measure — the share of rent-burdened households — we continue to fall behind. In most major metros, over 50% of renter households are burdened, or pay over 30% of income on rent as of 2021. RCLCO and the ULI Terwilliger Center for Housing have collaborated to develop the Housing Progress Index to answer the key question: which U.S. regions have been making the most forward progress relative to three widely shared housing goals that relate to expanding attainability: increase the level of new supply, increase housing diversity, and reduce housing (measured here as rental) cost burdens?

The index emphasizes simplicity, focusing on only these three key metrics:

- The average annual percent change in overall housing units (with an increase being a positive score) over the past decade

- The average annual percent change in the housing diversity over the past decade (an abundance of different sizes of dwelling units, including duplexes, multifamily units, etc. is a positive score)

- The average annual percent change in rent burdened households over the past decade (a decreasing share is a positive score)

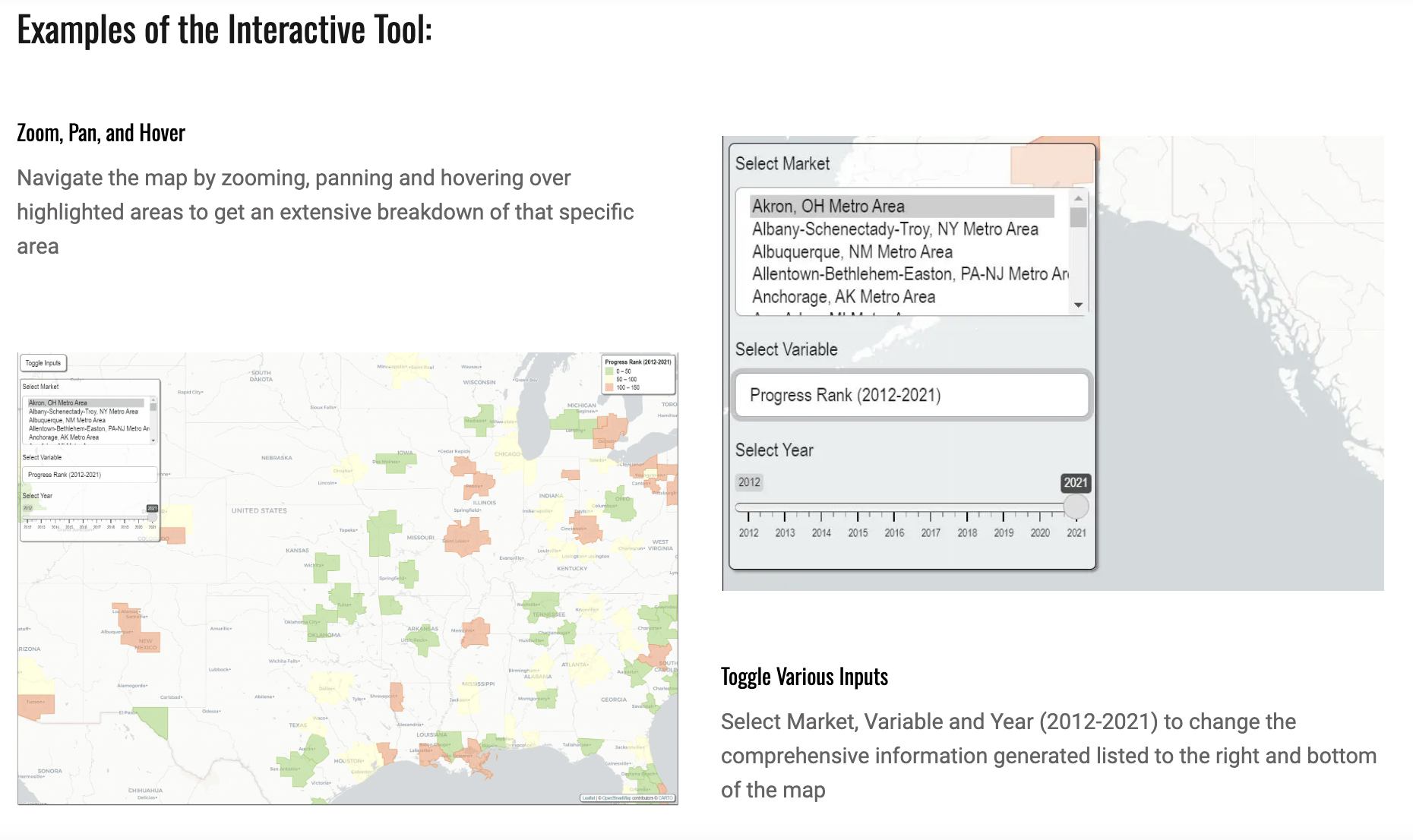

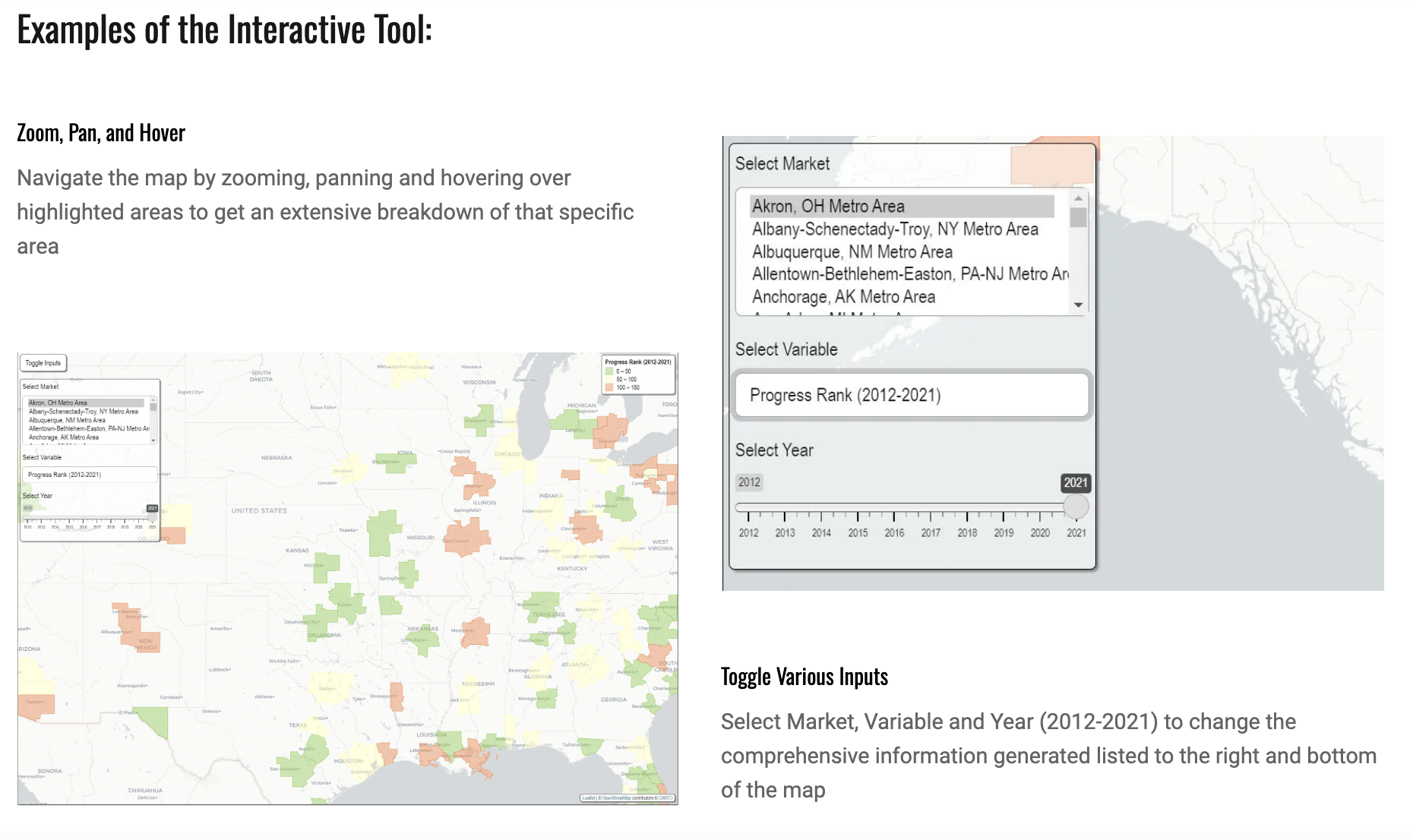

The three factors are weighted equally and aggregated into an index that ranks overall progress for the top 150 largest MSAs in the U.S., as a way to help understand where housing production conditions are most improving and where they are getting worse relative to the goal of expanded housing attainability. The interactive tool allows for users to toggle the different metrics for different years, as well as view the overall past decade progress rank for one MSA at a time.

Access the tool on RCLCO's website here.

レポートの概要:As housing attainability challenges in the United States have spread beyond the typical “high-cost coastal markets,” continued attention is needed regarding the relationship between slowing new housing supply and the crisis of affordability. Recent research indicates that there is a national production shortfall of 3.79 million housing units, with 169 regions experiencing underproduction as of 2019. Both indicators have worsened since 2012.[1] While there was a ramp up in supply coming out of Great Financial Crisis of 2008, affordability has been a consistent challenge across many major markets, and activity has not been equal across market sizes, geographies, or types.

While some markets continue to add, and a few even show signs of accelerating new supply, others including some so-called low barrier to entry markets, have stagnated. Of equal concern, density and diversity of new housing supply has only made marginal changes in most markets over the past decade. Growing deliveries of multifamily housing are one bright spot, but the response of the housing industry has been limited compared to changing demand conditions. Under-production and the continued dominance of the single-family home contribute to slow progress toward the goal of a housing delivery system for the U.S. that meets the consumer needs and economics and raising level of housing budget.

By one critical demand measure — the share of rent-burdened households — we continue to fall behind. In most major metros, over 50% of renter households are burdened, or pay over 30% of income on rent as of 2021. RCLCO and the ULI Terwilliger Center for Housing have collaborated to develop the Housing Progress Index to answer the key question: which U.S. regions have been making the most forward progress relative to three widely shared housing goals that relate to expanding attainability: increase the level of new supply, increase housing diversity, and reduce housing (measured here as rental) cost burdens?

The index emphasizes simplicity, focusing on only these three key metrics:

- The average annual percent change in overall housing units (with an increase being a positive score) over the past decade

- The average annual percent change in the housing diversity over the past decade (an abundance of different sizes of dwelling units, including duplexes, multifamily units, etc. is a positive score)

- The average annual percent change in rent burdened households over the past decade (a decreasing share is a positive score)

The three factors are weighted equally and aggregated into an index that ranks overall progress for the top 150 largest MSAs in the U.S., as a way to help understand where housing production conditions are most improving and where they are getting worse relative to the goal of expanded housing attainability. The interactive tool allows for users to toggle the different metrics for different years, as well as view the overall past decade progress rank for one MSA at a time.

Access the tool on RCLCO's website here.